Services

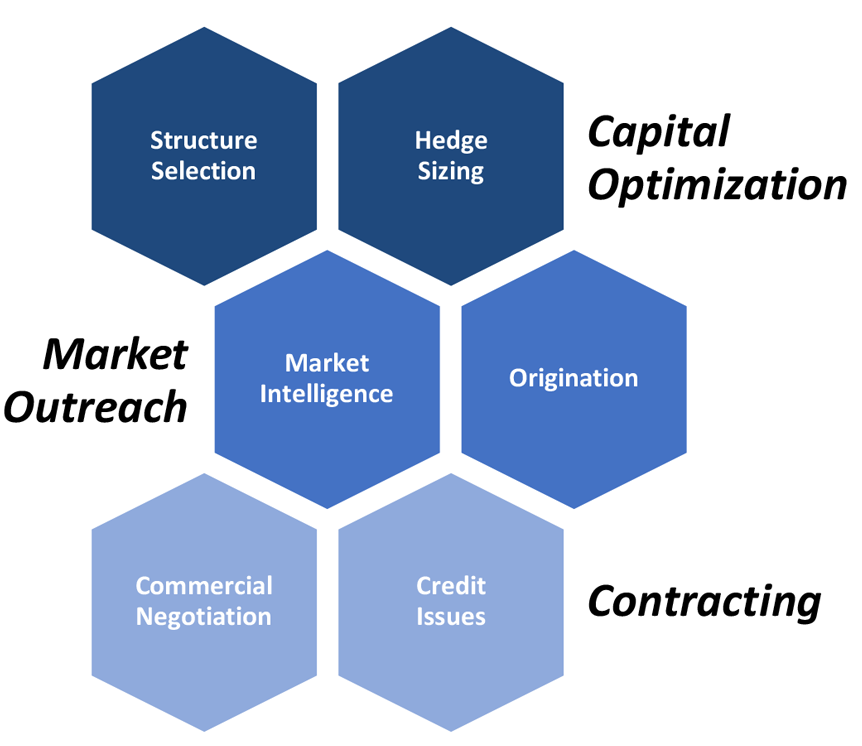

Snapper Creek Energy Advisors (“Snapper”) works with clients to facilitate successful commercialization of projects and execution of transactions (buy- or sell-side) by structuring and executing commodity hedges in order to support financing, optimize the capital structure and maximize returns.

Snapper’s expertise stems from its principals’ broad and successful track records in originating, structuring, and executing commodity off-takes and commodity-linked financings as well as principal investments in the conventional and renewable power sectors.

Snapper has a significant track record of structuring of offtake agreements, especially in the power and gas space. Clients have benefited from creative structures to maximize value for the sponsor.

Offtake Structuring and Origination for New Projects

Snapper has demonstrated experience in tailoring solutions to meet clients’ risk management objectives while minimizing costs. We support clients on all aspects of developing and implementing commercial solutions for energy assets including structuring, origination, negotiation with counterparties and discussions with potential investors.

Risk Management Solutions for Operating Assets

We understand that the offtake arrangements put in place to support initial financing may not meet continuing needs due to changes in capital structure or the changing market conditions. Snapper works with sponsors to analyze current hedge arrangements and work with counterparties on potential restructuring and/ or risk management solutions to address changing conditions.

We leverage our expertise in the commodity markets to help operating assets with revenue solutions in support of asset acquisition and/ or refinancing.